Healthcare providers glean massive amounts of information when treating patients; it takes more than 300 data points to process just one encounter. Luckily, patient demographic data can inform nearly every interaction people have with healthcare providers, from initial treatment all the way to hospital discharge.

In particular, the data that providers collect can be used to simplify the payment process and help patients pay their bills. Patient demographic data isn’t just people’s names, addresses, and insurance specifics. It also includes an individual’s payment preferences (check, debit, etc.) and communication habits (text, web chat, etc.).

For instance, an automated follow-up email might be more than enough to remind someone to complete the process. On the other hand, someone may need a paper statement and a targeted call to resolve their bills. That’s what data analysis in healthcare can reveal: how to improve the patient payment process.

Why Are Demographics Important?

Patient demographics help predict an individual’s propensity to pay, which is especially important given that more financial responsibility now rests on patients’ shoulders. By examining previous bills, payment history, and past correspondence as well as an individual’s financial status, providers can determine someone’s ability and desire to pay.

For example, a patient may have a low ability but high desire to resolve outstanding payment. Learning this is the key to improving collections. Patient demographic data provides a clearer picture of whoever a provider intends to interact with.

The payment process shouldn’t be a frustrating experience for anyone. Data shows which patients have a higher propensity to pay, in allowing providers to tailor communication accordingly. With this knowledge, providers can decide whether to gently remind patients or take a more direct approach.

Utilizing Patient Demographics for Better Care

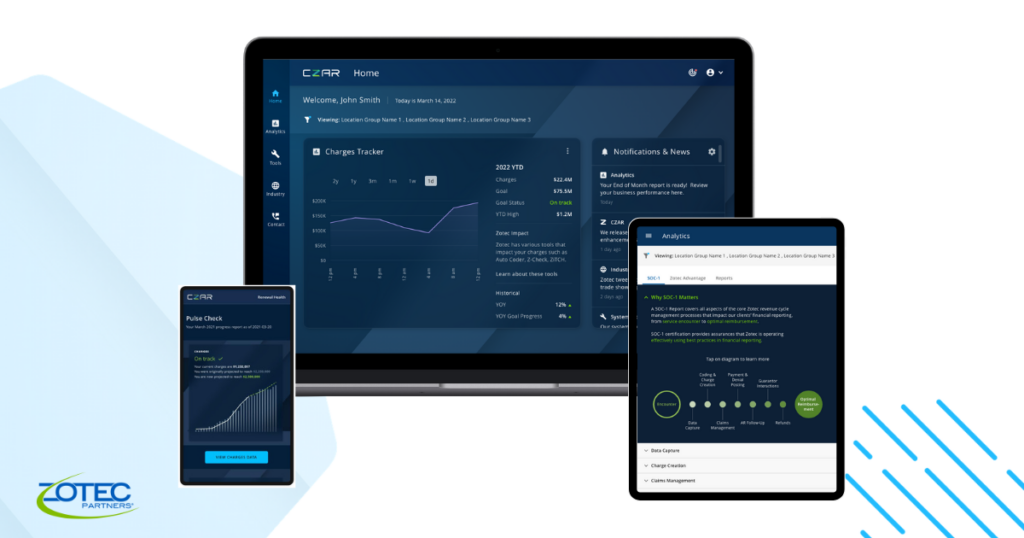

At Zotec Partners, our understanding of patients comes from daily involvement. Tens of thousands of daily interactions, adding up to millions each year, have helped us build policies, tactics, and workflows that meet patients where they are and enable a more effective collections process for our clients — all while treating patients with the compassion and empathy they deserve. After all, patients can be sick, scared, confused, or even unsure about how they will pay their bills. We know that one size doesn’t fit all. It takes sophisticated technology, empathetic staff members, and smart, personalized approaches to optimize outcomes for clients and patients alike.

It shouldn’t come as much of a surprise that past behavior is the probably most important variable for accurate payment predictions. Our machine learning, patient demographic data, and data analytics tools can identify valuable quantitative variables predicting the likelihood of bill payment. Based on communications preferences and propensity to pay factors, it then becomes much easier to arrive at the best next steps for claims resolution.

To further enhance efficiencies, we’ve also developed personas and situations for our patient experience team. Whether taking a call, answering a chat, or responding to an email, they’re equipped to handle the situation in the best possible way. If a patient can’t afford to pay and needs information about their options, our team knows how to respond with aid and compassion. If someone doesn’t understand why insurance hasn’t paid for a procedure, our team is ready to explain.

To optimize this process, providers have the option to set apart CPT codes that vary significantly in payment likelihood and flag them for customized collections strategies. We still do our due diligence by identifying patients who, for example, are more likely to pay when provided upfront cost estimates or offered payment plans. We can also flag patients whose insurance information is out of date or patients who hit their out-of-pocket maximum. These details allow us to take a more proactive approach to communication and ensure a good patient experience.

If the goal is to increase lifetime collections from patients, providers need to double down on optimal collection strategies. Technology can do only so much. Using easy-to-understand terms, user-centric design, and multiple communication channels can all help improve the payment process and the patient experience. To learn more about our end-to-end healthcare billing solutions, click here.