Anesthesiology Digest: News from July 2021.

CMS Releases 2022 PFS and QPP Proposed Rule

July 14, 2021

The Centers for Medicare and Medicaid Services (CMS) has released a 1,747 page rule with its proposed actions for CY 2022.

Fee Schedule Provisions:

Conversion factors (CF) are proposed to decrease due to two factors:

To read more, go to ASA’s website.

CMS Releases 2022 Proposed Medicare Physician Fee Schedule

July 13, 2021

The Centers for Medicare & Medicaid Services (CMS) released the calendar year 2022 Medicare Physician Fee Schedule (MPFS) proposed rule, which includes payment provisions and policy changes to the Quality Payment Program (QPP) for 2022 and beyond.

Medicare Physician Fee Schedule (MPFS)

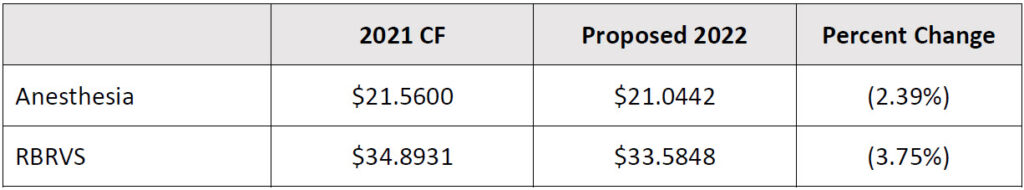

With the proposed budget neutrality adjustment to account for changes in RVUs, and expiration of the 3.75% payment increase provided for CY 2021 by the Consolidated Appropriations Act, 2021 (CAA) the proposed 2022 MPFS conversion factor is $33.5848; a 3.75% decrease from 2021’s $ 34.8931.

The separately calculated Anesthesia Conversion Factor is proposed at $21.0442, a 2.39% decrease from the 2021 conversion factor of $21.5600.CMS estimates an overall impact to allowed charges from MPFS proposed changes as follows:

Additional Resources:

UnitedHealth’s Limits on Out-of-network Care Seen as Surprise Billing Ban Reaction

By Nona Tepper | July 7, 2021

UnitedHealth Group’s decision to end some out-of-network coverage caught providers by surprise, with many speculating the move is part of a broader set of policies by the nation’s largest insurer aimed at controlling costs and lowering provider reimbursement.

Starting July 1, UnitedHealthcare no longer pays out-of-network claims when fully insured customers seek non-emergency care outside of their local coverage area. Patients seeking treatment from “step down” facilities away from where they live, including skilled nursing homes, residential treatment facilities, inpatient rehabilitation programs and more, are subject to the new rule. Coverage areas typically include the entire state and surrounding states where patients reside.

“Anyone currently receiving treatment will be allowed to continue their treatment without disruption,” a United Healthcare spokesperson wrote in an email. The company instituted the change as a way to reduce costs and improve quality care, according to the spokesperson.

United rolled out the policy to a select number of fully insured employer plans and individual market health products, which must fully adopt the new restrictions by mid-2022. The insurer notified providers of the new policy in June, just days before CMS published an interim final rule implementing the surprise billing protections President Joe Biden enacted this year.

“Over the course of a couple of days, we just started getting call after call from people freaking out about it,” said Zachary Rothenberg, a partner at the Los Angeles-based law firm

Nelson Hardiman, which represents a number of behavioral health providers. “The rumor mill, as you can imagine, is hot.”

To read more, go to Modern Healthcare.

Physician Compensation Plateaus During Pandemic

By Ginger Christ | July 6, 2021

As doctors’ offices shut down and hospitals paused elective procedures during the height of the COVID-19 pandemic last year, patient volumes for healthcare providers nosedived. And with them, productivity-based financial gains for physicians.

Physicians, who typically see cost-of-living pay increases each year, generally experienced much more modest salary gains in 2020, according to Modern Healthcare’s 28th annual Physician Compensation Survey, which analyzes data from surveys of 10 placement firms.

“There’s been this trend year-over-year of increases in salary but we saw that stop,” said Michael Belkin, a divisional vice president at physician staffing firm Merritt Hawkins.

In 2020, the overall average of the reported median physician compensation inched upward less than 0.5% from the previous year to $416,966. Compare that to 2019 when the overall average increased 2.7% from the year before.

There largely wasn’t a major drop in physician compensation, as might have been expected during the pandemic, said Dave Hesselink, a principal at workforce consulting group SullivanCotter.

“The reason for that is most large organizations helped protect physician compensation, especially during that large shutdown,” Hesselink said.

In a survey SullivanCotter conducted last fall, about two-thirds of the organizations that responded said they had protected physician compensation to some degree in 2020. In some cases, those were short-term protections that lasted during the shutdown and, in others, adjustments were made to the salary floor, said Patty Bohney, a principal in SullivanCotter’s physician workforce practice.

“There have been some winners and there have been some specialties that have not bounced back as fast as others,” Belkin added. “Specialists have continued to be in high demand.”

In 2020, medical oncology saw the largest year-over-year gains, recording a 5.6% increase to an average compensation of $458,127, according to the survey. Pediatricians’ compensation, meanwhile, took the biggest hit, falling 3.3% to an average of $245,783.

On top of that, the number of physician jobs Merritt Hawkins was asked to fill was down about 25% from the previous year, Belkin said.

To read more, go to Modern Healthcare.

First Rule for Federal Surprise Medical Bill Law Released

July 2, 2021

On July 1, the Department of Health and Human Services (HHS), the Department of Labor, and the Department of the Treasury, along with the Office of Personnel Management released an interim final rule with comment period (IFC), entitled “Requirements Related to Surprise Billing; Part I.” This rule implements the No Surprises Act which was part of the Consolidated Appropriations Act of 2021. It establishes rules around surprise medical bills when care is received either in or out-of-network. This is the first of three rules that are expected to be released. This first rule will establish the methodology and information payers must use to make payments, as well as procedure for making complaints about payers. The comment period will begin soon and will last 60 days.

The No Surprise Act created an independent dispute resolution (IDR) process for when payers and physicians disagree over the payment amount. ASA strongly advocated for and was successful in ensuring that public payer rates could not be used in this arbitration process. The law goes into effect on Jan. 1, 2022.

ASA is continuing to review the rule and will provide further updates including guidance on submitting comments.

Additional Information:

Key Surprise Billing Ban Details Still Murky for Providers, Insurers

July 2, 2021

With five months before the surprise billing ban takes effect, the Biden administration hasn’t released many of the most important details about how the No Surprises Act will work, leaving providers and insurers little time to plan for the changes.

CMS’ first rule outlawing balance billing contained expected patient protections against surprise billing and high cost-sharing for out-of-network care, as outlined in the December law.

But providers and insurers are still in the dark about the independent dispute resolution process and how regulators will define key terms for arbitrators or calculate median in-network rates.

“It’s not really what providers or payers were looking for,” Avalere Health consultant Tim Epple said. “I don’t think there is anything that we’ve seen that differed meaningfully from the legislative text or the intent of the statute.”

Healthcare executives could start to get antsy as the Biden administration approaches its self-imposed October 1 deadline to wrap up the rulemaking process, he said. Without more information about how regulators will define geographic regions, immediate in-network rate comparison and other aspects of the law, providers could struggle to figure out their risk exposure and strategy for dealing with the surprise billing ban.

“If they wait until October, that’s a pretty tight time crunch for what is going to be a fair bit of change,” Epple said.

The patient protections will have the greatest effect on consumers and will ultimately affect insurers’ health plan documents during open enrollment this fall, Manatt Health partner Michael Kolber said.

But later rules will squarely address provider-payer business relationships. Congress didn’t give the Biden administration much wiggle room to determine the so-called “qualifying payment amount,” which the law defines as an insurer’s historical median in-network rate for a given service. Arbitrators will use that information to help settle payment disputes among providers and insurers and, in turn, decide how much consumers must pay out-of-pocket for related services.

“It will force providers and payers to agree on a price,” Waller Law partner Patsy Powers said.

Both providers and payers have strong incentives to bill and pay reasonable rates from the outset because the surprise billing ban leans on an insurer’s median, rather than average, historical in-network rate. Neither side is likely to get much out of arbitration in most cases.

To read more, go to Modern Healthcare.

Learn more about what Zotec Partners can do for your anesthesiology practice here.