Anesthesiology Digest: News from November 2021.

Congressional Doctors Lead Bipartisan Revolt Over Policy on Surprise Medical Bills

By Michael McAuliff | November 17, 2021

The detente that allowed Congress to pass a law curbing surprise medical bills has disintegrated, with a bipartisan group of 152 lawmakers assailing the administration’s plan to regulate the law and medical providers warning of grim consequences for underserved patients.

For years, people have faced these massive, unexpected bills when they get treatment from hospitals or doctors outside their insurance company’s network. It often happens when patients seek care at an in-network hospital but a physician such as an emergency room doctor or anesthesiologist who treats the patient is not covered by the insurance plan. The insurer would pay only a small part of the bill, and the unsuspecting patient would be responsible for the balance.

Congress passed the No Surprises Act last December to shield patients from that experience after long, hard-fought negotiations with providers and insurers finally yielded an agreement that lawmakers from both parties thought was fair: a 30-day negotiation period that would be followed by arbitration when agreements cannot be reached.

The rule, which would take effect in January, effectively leaves patients out of the fight. Providers and insurers have to work it out among themselves, following the new policy.

But now many doctors, their medical associations and members of Congress are crying foul, arguing the rule released by the Biden administration in September for implementing the law favors insurers and doesn’t follow the spirit of the legislation.

“The Administration’s recently proposed regulation to begin implementing the law does not uphold Congressional intent and could incentivize insurance companies to set artificially low payment rates, which would narrow provider networks and potentially force small practices to close thus limiting patients access to care,” Rep. Larry Bucshon (R-Ind.), who is a doctor and helped spearhead a letter of complaint this month, said in a statement to KHN.

Nearly half of the 152 lawmakers who signed that letter were Democrats, and many of the physicians serving in the House signed it. But the backlash has not won the support of some powerful Democrats, including Rep. Frank Pallone (N.J.), chair of the Energy and Commerce Committee, and Sen. Patty Murray (Wash.), chair of the Senate Health, Energy, Labor and Pensions Committee, who wrote to the administration urging officials to move forward with their plan.

Some members of Congress who are also doctors held a conference call with the administration late last month to complain, according to aides to lawmakers on Capitol Hill, who could not speak on the record because they did not have authorization to do so. “The doctors in Congress are furious about this,” said one staff member familiar with the call. “They very clearly wrote the law the way that they did after a year, or two years, of debate over which way to go.”

The controversy pertains to a section of the proposed final regulations focusing on arbitration.

The lawmakers’ letter — organized by Reps. Thomas Suozzi (D-N.Y.), Brad Wenstrup (R-Ohio), Raul Ruiz (D-Calif.) and Bucshon — noted that the law specifically forbids arbitrators to favor a specific benchmark to determine what providers should be paid. Expressly excluded are the rates paid to Medicare and Medicaid, which tend to be lower than insurance company rates, and the average rates that doctors bill, which tend to be much higher.

Arbitrators would be instructed to consider the median in-network rates for services as one of several factors in determining a fair payment. They would also have to consider items such as a physician’s training and quality of outcomes, local market share of the parties involved where one side may have outsize leverage, the patient’s understanding and complexity of the services, and past history, among other things.

But the proposed rule doesn’t instruct arbiters to weigh those factors equally. It requires them to start with what’s known as the qualifying payment amount, defined as the median rate the insurer pays in-network providers for similar services in the area.

If a physician thinks they deserve a better rate, they are then allowed to point to the other factors allowed under the law — which the medical practitioners in Congress believe is contrary to the bill they wrote.

The provisions in the new rule “do not reflect the way the law was written, do not reflect a policy that could have passed Congress, and do not create a balanced process to settle payment disputes,” the lawmakers told administration officials in the letter.

To read more, go to Kaiser Health News.

2020 QPP Data Preview Period Opens for Doctors and Clinicians

November 16, 2021

This week, the Centers for Medicare & Medicaid Services (CMS) opened access for doctors and clinicians to view their 2020 Quality Payment Program (QPP) data in a month-long Preview Period. Eligible clinicians (ECs) and their groups can view their profile information and performance data on the QPP website before it is made available to the public on Medicare Care Compare and in the Provider Data Catalog in 2022. The Preview Period will close on December 14, 2021 at 8 p.m. ET.

This period may provide data particularly relevant to anesthesiologists on two measures: “AQI48: Patient-Reported Experience with Anesthesia” and “AQI56: Use of Neuraxial Techniques and/or Peripheral Nerve blocks for Total Knee Arthroplasty.”

ASA recommends that ECs review their profiles and metrics to check for discrepancies before the Preview Period closes.

Accountable Care Organizations participating in the Shared Savings Program can preview their performance data in their 2020 Merit-based Incentive Payment System (MIPS) Performance Feedback Reports.

For the full guide on how to access the QPP preview period, click here.

For more details on the Quality Payment Program, visit the QPP resource library.

To read more, go to ASA’s website.

Medicare Premiums Will See Big Increase In 2022

By Nona Tepper and Maya Goldman | November 12, 2021

Medicare members’ monthly premiums for physician and outpatient services will increase nearly 15% in 2022, the Centers for Medicare and Medicaid Services said in a news release Friday.

The agency attributed the increases to rising healthcare prices driven by COVID-19-related care, lawmakers’ moves to lower 2021 premiums during the pandemic and the potential for pricey drugs like Biogen’s Aduhelm to receive coverage.

The standard monthly premium will rise to $170.10 in 2022, up 14.5% from $148.50 this year. The annual deductible will grow $233, up 14.7% from $203 in 2021. Enrollees will receive a 5.9% year-over-year cost of living adjustment through their Social Security benefits, which will more than cover the increase in Medicare Part B monthly premiums, the agency said. CMS said it was the largest cost of living increase in 30 years.

Medicare premiums for hospital inpatient care will also go up in 2022, though CMS notes that about 99% of beneficiaries don’t pay premiums for these services. Still, those who are subject to the costs will pay a $1,556 deductible if admitted to the hospital in 2022, an increase of $72 from $1,484 in 2021. Daily coinsurance rates for the 61st through 90th days of hospital care for a beneficiary, lifetime reserve days and skilled nursing facility stays will also increase in 2022.

“CMS is committed to ensuring high quality care and affordable coverage for those who rely on Medicare today, while protecting Medicare’s sustainability for future generations,” CMS Administrator Chiquita Brooks-LaSure said in a news release. “The increase in the Part B premiums for 2022 is continued evidence that rising drug costs threaten the affordability and sustainability of the Medicare program.”

Beneficiaries with Medicare drug coverage will see monthly premiums ranging from $0 to $77.90, based on their incomes.

To read more, go to Modern Healthcare.

Health Insurers’ 2021 Looking Like a Rerun of Last Year

By Mari Devereaux | November 10, 2021

This year is looking to be very similar to last year for health insurance companies: Older patients continue to defer care, COVID-19 costs are a burden and record profits are the end result.

Reality isn’t matching expectations. Health insurance companies predicted a flood of patients who’d gotten sicker as they put off care during the first year of the pandemic would rush back. The assumption that medical expenses would rise was built into higher premiums for this year. But insurance companies guessed wrong and utilization remains depressed.

On net, this has worked out fine for insurers. Lower-than-expected costs tend to translate into higher profits, although the Affordable Care Act’s medical-loss ratio rebates limit how much insurance companies can benefit financially when they overshoot on premiums.

Health insurers have eyed their surprise boon as a means to spend on new initiatives, said Adam Block, a public health professor at New York Medical College and founder of Charm Economics.

“Health plans are looking at these [claims] reductions and switches to telehealth—a less expensive platform—and thinking about ways that they can invest the savings into improving the health of their population,” Block said.

Insurers are particularly focused on caring for the lucrative and growing Medicare Advantage population. Older people forgoing care makes it harder for insurers to anticipate their current and future medical needs. Incomplete information can lead to inaccurate risk scores, which can cut into Medicare reimbursements under the risk-adjustment program.

To read more, go to Modern Healthcare.

Outpatient Facilities Will Take a Financial Hit as CMS Reworks Inpatient-only List Policy

By Alex Kacik | November 10, 2021

The Centers for Medicare and Medicaid Services is walking back its push to pay for more complex services without inpatient stays, a move that will dent revenues for health systems that have boosted investment in outpatient facilities.

The agency announced during the Trump administration that it would phase out its list of around 1,700 services Medicare would only pay for on an inpatient basis due to the complexity of the procedure, the underlying physical condition of the patient or the need for at least 24 hours of postoperative recovery time. CMS began that phase-out in 2021 by removing 298 services from the list.

But after heavy lobbying from hospital and physician associations over safety concerns, the Biden administration’s CMS said it would pause the phase-out plans and add back almost all the services it removed from the inpatient-only list last year. CMS also removed most of the more than 260 procedures that had been added to a separate ambulatory surgical center covered procedures list in the 2021 rule.

The delay, as outlined in the Outpatient Prospective Payment System final rule issued last week, represents a stark change from CMS’ typical messaging. The agency has largely been proposing regulations that would move care from high-cost inpatient treatment to ambulatory surgery centers and other outpatient facilities.

CMS said in the 2022 final rule that it realized the three-year timeframe for phasing out the list was too short and that it needs more time to evaluate whether the services removed in 2021 should actually be taken off the list.

“It seems like a complete 180,” said Susan Maupin, vice president at the healthcare consultancy Advis. “But whenever there are safety concerns expressed by providers, CMS should rightfully take a step back and reevaluate if there are any legitimate concerns.”

That earlier push to move away from inpatient care, in part, has prompted health systems to increase investment in outpatient facilities. But those new surgery centers will likely take a financial hit as CMS reworks its approach.

“Business plans for those trying to build an ASC will be blown out of the water for a little bit of time, but I don’t think it will be a permanent change,” said Monica Hon, vice president at Advis, who was supportive of regulators taking a step back.

While the Ambulatory Surgical Center Association strongly opposed CMS’ removal of most services added to the ASC-covered procedures list in 2021, the organization was on board with the agency’s announced pause. In comments on the proposed rule, the group expressed concerns with completely changing course on the policy. Although ASCs can’t always immediately perform procedures removed from the inpatient-only list, allowing a service to be performed at a hospital outpatient department could be a precursor to adding it to the ASC list.

ASCA asked CMS to keep three services that have been performed in ASCs on other patient groups off the inpatient-only list in 2022, which the agency agreed to do in the final rule.

To read more, go to Modern Healthcare.

ASA-Supported Congressional Letter Calls on Biden Administration Officials to Fix Flawed No Surprises Act Rule

November 8, 2021

Last week, a bipartisan group of over 150 members in the House of Representatives sent a formal communication to Biden Administration officials urging the interim final rule (IFR) released on September 30 be amended to align the law with the intent of the Congressional legislation.

The actual text of the No Surprises Act law as passed by Congress creates a fair independent dispute resolution (IDR) process under which physicians have an

opportunity to secure a reasonable payment. Parameters of the IDR process in the recently released IFR, however, do not reflect the way the law was written. Rather, the rule designed an IDR process that heavily favors health insurance companies in payment disputes by directing the arbiter to give the highest priority to the insurer-calculated median in-network amount over other considerations and arguments presented by physicians.

The letter – led by Rep. Thomas Suozzi (D-NY-3), Rep. Brad Wenstrup, DPM (R-OH-2), Rep. Raul Ruiz, MD (D-CA-36) and Rep. Larry Bucshon, MD (R-IN-8) – was sent to Secretary of Health and Human Services Xavier Becerra, Secretary of the Treasury Janet Yellen, and Secretary of Labor Marty Walsh, who are responsible for federal rulemaking to implement the legislation’s provisions guiding payment disputes between physicians and insurance companies. The letter urges revision of the IFR by specifying that the certified IDR entity should not default to the median in-network rate and should instead equally consider information and arguments presented by physicians.

ASA-member grassroots activists generated over 1,500 messages to the Hill and played a key role in securing many of the Congressional signatories calling for the successful and fair implementation of the No Surprises Act.

ASA continues to work tirelessly with Congress and the Biden Administration to ensure that the No Surprises Act is implemented in a manner consistent with Congressional intent.

To read more, go to ASA’s website.

CMS Requires COVID Vaccines for Healthcare Staff by Jan. 4

By Maya Goldman | November 4, 2021

The Centers for Medicare & Medicaid Services will require COVID-19 vaccines for all employees at Medicare and Medicaid-participating healthcare facilities by Jan. 4, and the Occupational Safety and Health Administration will require all employees at businesses with 100 or more workers to be vaccinated by the same date or get tested for the virus weekly, the agencies announced Thursday morning.

President Joe Biden in September directed the two agencies to put out policies for staff vaccination requirements as part of the administration’s national vaccine strategy. Biden also required federal contractors to get vaccinated against COVID-19 in an executive order.

The CMS will require healthcare facilities that participate in Medicare or Medicaid—including hospitals, long-term care facilities, ambulatory surgery centers, dialysis facilities, home health agencies and more—to make sure all clinical and non-clinical employees are vaccinated by the Jan. 4 deadline. The interim final rule stipulates that fully vaccinated means two doses of the Pfizer or Moderna vaccine or one dose of Johnson & Johnson, meaning booster shots are not mandated.

The administration estimates the CMS mandate will apply to more than 17 million healthcare workers at roughly 76,000 facilities.

OSHA’s rule, created as an emergency temporary standard, requires businesses with 100 or more staff to have all staff fully vaccinated by Jan. 4. Employees who are still unvaccinated at that point will need to show a negative COVID-19 test weekly and wear a face mask in the workplace. The rule doesn’t require employers to provide or pay for tests, but a fact sheet notes that other laws or collective bargaining agreements might leave employers on the hook for these costs on a case-by-case basis. Employers must provide paid time off for staff to get vaccinated under the rule.

Healthcare employees will not have the option of regular COVID-19 testing instead of getting vaccinated as a way to protect patient safety, a senior administration official said on a Wednesday night call. Medical and religious exemptions are allowed for healthcare workers under the rule, the official said.

To read more, go to Modern Healthcare.

2022 Locale Specific Medicare Anesthesia Conversion Factors

November 4, 2021

With release of the Final Rule for 2022 MPFS, the Centers for Medicare and Medicaid Services (CMS) has published the locale specific anesthesia conversion factors (CF).

These are available on the ASA Website.

Aetna Expects to Add at Least 100K Members in ACA Exchange Plans for 2022

By Paige Minemyer | November 3, 2021

CVS Health CEO Karen Lynch told investors on Wednesday morning that Aetna is expecting to add at least 100,000 new members in 2022 through its slate of plans on the Affordable Care Act’s exchanges.

The insurer has returned to the Affordable Care Act’s exchanges in eight states for 2022, and the insurer is expecting its plans, which include a co-branded offering with both Aetna and CVS, to have an immediate appeal in the individual market.

Lynch described the new plan on the company’s second-quarter earnings call as one “that combines health insurance, pharmacy, our retail presence and behavioral health services.”

Aetna fully exited the ACA exchanges in 2018 amid a mass payer exodus following significant losses. Lynch said Aetna would be re-entering the markets for the 2022 plan year during the company’s Q4 2020 earnings call.

Open enrollment on the ACA exchanges began on Monday.

In addition, Aetna is drawing interest for its newly-unveiled virtual primary care offering, Lynch said. The program, which was announced in August, is backed by Teladoc as well as services provided by CVS Health.

Members will have continuous access to a virtual primary care doctor and can connect to a number of specialists and other physicians based on their needs. They can also access a number of virtual and in-person services with a $0 copayment through CVS’ MinuteClinics.

Lynch said that the solution has 30 accounts signed on, reaching 750,000 members for Jan. 1, 2022.

To read more, go to Fierce Healthcare.

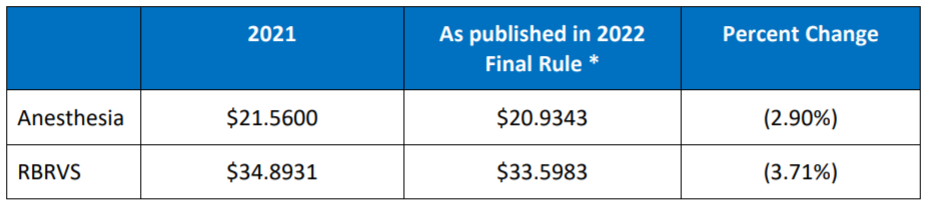

CMS Releases 2022 MPFS and QPP Program Final Rule

November 2, 2021

On November 2, 2021, the Centers for Medicare & Medicaid Services (CMS) released its Medicare Physician Fee Schedule (MPFS) and Quality Payment Program (QPP). The rule includes payment and quality provisions that take effect on January 1, 2022.

Payment Provisions – Conversion Factors

The conversion factors decrease as anticipated, but ASA and others will continue our work to

get Congressional relief. As was that case for 2021, final resolution may not come until late

December. However, the conversion factors as published today are as follows:

*The conversion factors as published reflect the take back of the 3.75% increase Congress approved for the 2021 fee schedule. In addition, physicians and other health care professionals are facing reinstatement of a 2% sequestration cut plus a 4% PAYGO cut that is part of the American Rescue Plan.

To read more, go to ASA’s website.

Learn more about what Zotec Partners can do for your anesthesiology practice here.