On September 21, 2021, Zotec Partners hosted a Zotec Shares Webinar with a special guest panel titled No Surprises Act: Why it Matters Right Now.

The three members of the expert-led panel included:

In this Zotec Shares webinar, our panel graciously shared insights into the No Surprises Act. Read below for a summary of our discussion along with takeaways to help practices understand and implement the new legislation.

The No Surprises Act (NSA) is a federal law with very broad application to health insurance plans with few exceptions and is designed to protect patients in group, individual, ERISA, and ACA exchange plans. It was signed into law on December 27, 2020 and will go into effect on January 1, 2022. This is the first time that ERISA plans will be subject to federal comprehensive out of network (OON)/ balance billing (BB) restrictions.

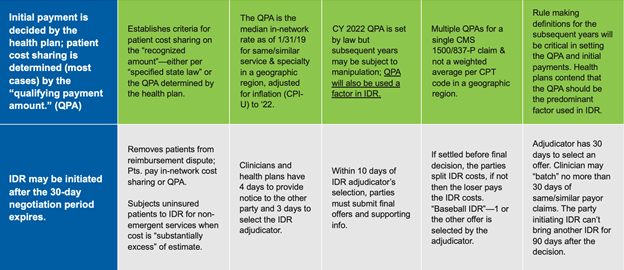

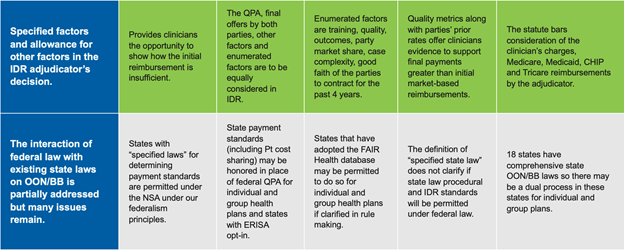

The first interim final rule with comment (IFC) was issued in July 2021 and addressed important issues related to the patient cost-sharing (known as the “qualifying payment amount” or QPA), how NSA will interact with existing “specified state laws” and mandatory patient disclosure obligations for hospitals and physician groups. There is a second interim final rule due on October 21, 2021. This interim final rule with comment (IFR 2) will implement additional protections against surprise medical bills under the NSA, including provisions related to the IDR process.

Why does the No Surprises Act matter to you right now—whether your group is nearly 100% in-network or not?

The Congressional Budget Office (CBO) is a non-partisan group of accounting and finance professionals charged with “scoring” federal legislation as either costing money or saving money. Under the Pay As You Go (PAYGO) rule, if a bill costs money, Congress is supposed to either find savings from other bills or raise taxes.

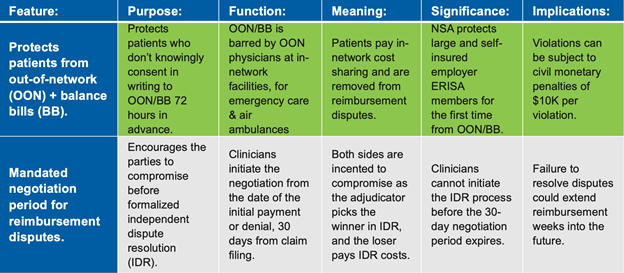

These are the key NSA features and implications as of the July 2021 interim Final Rule:

Watch for further updates on the second interim rule. Also, if you would like to learn more about our Advocacy work on this and other federal and state issues visit https://zotecpac.com/.

10/6/21 Update: